Creating a budget is the first step towards financial stability.

If you don’t have a budget to manage your expenses, now is the perfect time to look at how you’re spending your hard-earned money. During this time of financial uncertainty, it’s more important than ever to have a plan to guide your expenses. The key is to know where you always stand with your money.

Let’s get started and get to budgeting. Get out a couple pieces of paper, along with a sharpened pencil. Here are five steps for creating a budget:

- Determine how much money you make every single month.

Write this amount at the top of your paper. If the figure varies monthly, take an average of four months and use that as your average take-home income. - Calculate how much money you spend every single month.

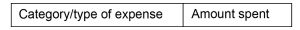

List out all the things you pay for each month. Develop two columns – the left side for the type of expense, and the right side for the expenditure.

For starters, you’ll have fixed expenses including rent/mortgage, transportation costs (gas and auto maintenance), utilities, medical, credit card payments and vehicle payments. Then you’ll have changing expenses including groceries, clothes, etc. Take an average of four months on what you spend on the changing expenses.

For starters, you’ll have fixed expenses including rent/mortgage, transportation costs (gas and auto maintenance), utilities, medical, credit card payments and vehicle payments. Then you’ll have changing expenses including groceries, clothes, etc. Take an average of four months on what you spend on the changing expenses. - Examine your spending.

Review where your money is going and look at ways you can cut back. Obviously, you’ll want to make sure you’re spending less than you make. If not, find ways to cut back. Even if you spend just $5 a week on snacks, that adds up to $260 a year, which is not insignificant. The money you think you are spending is a lot different than what you are spending. See our blog – Easy Ways to Save Money Now – for tips on how to save money.  Develop a plan.

Develop a plan.

Determine how much you will spend every month and write that down. The important thing is to stick to your plan as much as possible. A good rule of thumb is to add an extra 10 percent to 15 percent to your overall budget. So, if you’ve determined that you spend $800 a month, add $80 to $120 to your monthly expenses.- Record your spending and track your progress.

Track your spending on a regular basis to give you an accurate picture of where your money is going so you can adjust accordingly throughout the month.

The Make a Budget worksheet will help you list out how much money you spend monthly. If you want a tracking worksheet, you can download a “Really Simple Budget Worksheet” from Money Under 30 to help you keep up with your monthly expenses.

There’s an app for that!

If you don’t’ want to track your expenses on paper, you can track via apps/tools on your cell phone. Check out The 7 Best Budget Apps for 2020 by NerdWallet. Or you can manage your money Mint’s daily budget planner, both online and via an app.

Your budget doesn’t have to be complicated to be effective. A simple budget can go a long way towards helping you get your finances in order, and during these uncertain times, it’s critical to know where your money is going every month.

Be sure to check out our blog – Easy Ways to Save Money Now – that provides 12 money-saving tips to help you through these challenging times.

Let’s do this! Get started on your budget today!