Do you live paycheck to paycheck? Are your finances healthy?

Good financial health is about managing your finances to ensure you live comfortably and not stressing about money. It’s more than balancing a checkbook. It’s understanding the concepts of saving, eliminating debt and investing that leads to an overall sense of financial wellbeing. Practicing good financial skills reduces stress and provides overall peace of mind.

Here are five guiding principles for building financial literacy:

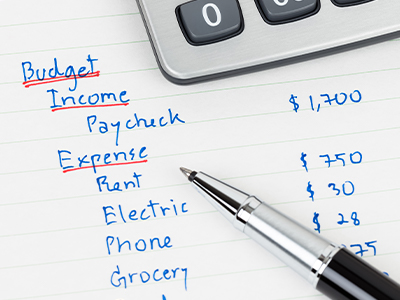

- Create a budget and set financial goals

Monitor your spending regularly. Budgeting is key to staying on top of your finances. Budgeting guidelines suggest that 60 percent be spent on essential items (e.g., housing, food, monthly bills), 20 percent on savings and 20 percent on discretionary items (e.g., the fun stuff).

Budgeting guidelines suggest that 60 percent be spent on essential items (e.g., housing, food, monthly bills), 20 percent on savings and 20 percent on discretionary items (e.g., the fun stuff). - Spend less than you earn

Know where your money is going and how much cash you’re bringing in monthly. - Save for your future – retirement!

Set a goal for how much you want to save monthly or each paycheck. Start simple and watch your money grow. It’s never too early to save for your future. Be sure you’re participating in your company’s 401(k) program.

Start simple and watch your money grow. It’s never too early to save for your future. Be sure you’re participating in your company’s 401(k) program. - Understand credit and credit scores

Know the facts about credit and interest rates. Pay off your credit card balances monthly to avoid interest charges. Monitor your credit report and know how to improve or maintain a good score. Good credit determines your interest rate, mortgage rate, ability to get loans and credit cards. - Build investing knowledge

Make your money work for you by knowing how the stock market and 401(k)s work. Investing allows you to grow your wealth and generate an additional income stream.

Investing allows you to grow your wealth and generate an additional income stream.

Being financially healthy means that you can cover your day-to-day and monthly expenses. It means buying extra things without struggling and covering unexpected emergencies. And finally, it’s about creating a plan – a budget – to achieve your financial goals.

Get started on your financial wellbeing journey today.

Check out our other Car-Mart blogs related to financing and money: